There is no easy elevator pitch for Bitcoin, a quick description that might entice a listener to become interested. It is impossible to describe or convey in just a minute or two. The most accurate and concise description I’ve heard was in a talk I watched on YouTube featuring Bitcoin expert Andreas M. Antonopoulos.

“Bitcoin is based on an open access participatory model of market based economic competition through risk and reward strategies based on game theoretical outcomes that ensure collaborative participation by multiple participants without anybody having the ability to cheat due to a system of emergent consensus based on mathematical rules and strong cryptography.”

—Andreas M. Antonopoulos

When I try to tell someone how revolutionary Bitcoin is, I know that I will fail to convince them. They already has some vague notion of what it is. They think they already know about it, or they’re in a rush, or they’ve been conditioned by a lifetime of schooling to misunderstand or be unaware of concepts of magnitude and complexity, so they simplify it and file it away. Plus, they’ve been conditioned by a media ecosystem that profits from conflict to believe that communication about a complicated subject is down to a handful of so-called experts shouting at each other between commercial breaks and the one who fires off the best sound bite at the end wins. The most I can hope for is to pique a person’s curiosity to learn for themselves.

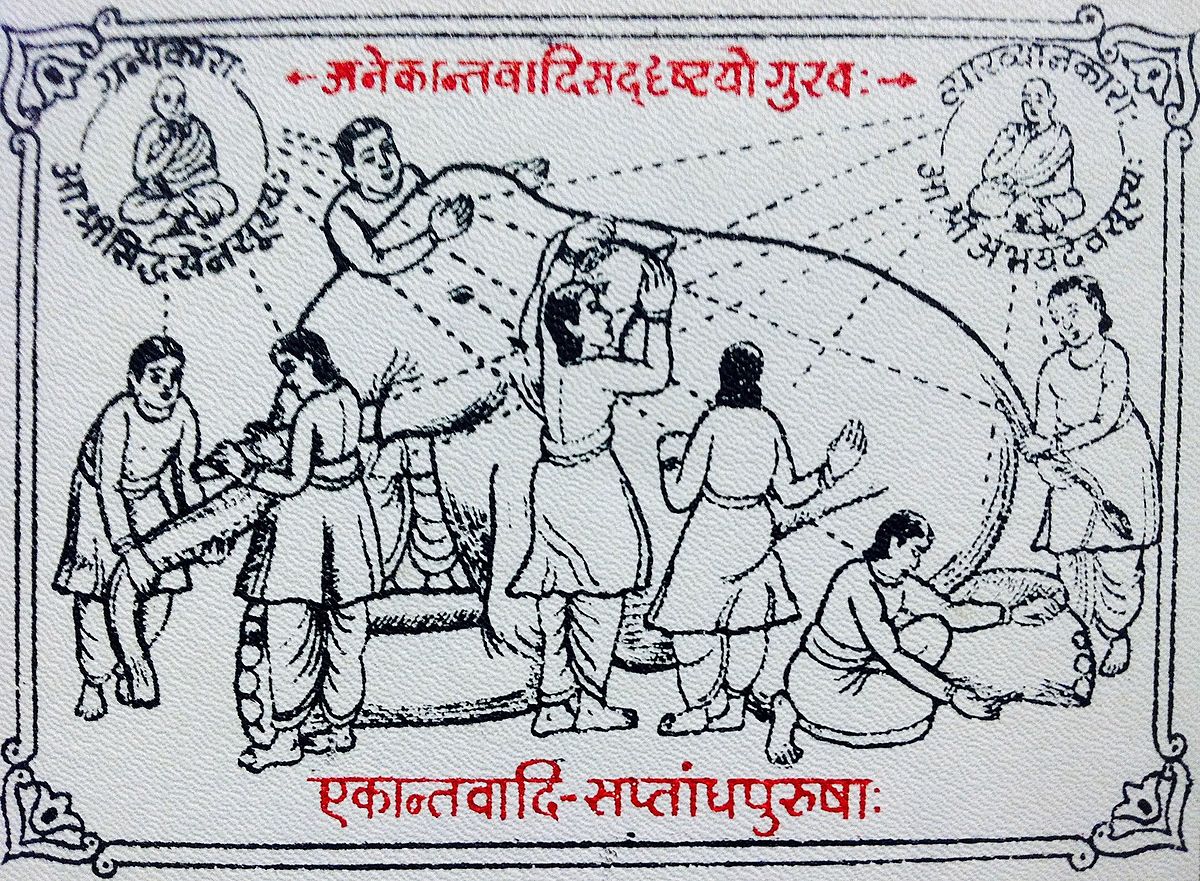

This scenario reminds me the parable of the blind men and the elephant. It’s an ancient story in which a group of blind men who have never seen nor heard of an elephant attempt to define it, each one touching and describing a part of it. Though they each have access to part of the truth, none has access to the totality of the truth.

In the 13th-century Jainist text Syādvādamanjari, Ãcārya Mallisena uses the parable “to argue that immature people deny various aspects of truth; deluded by the aspects they do understand, they deny the aspects they don’t understand.” He says, “Due to the extreme delusion produced on account of a partial viewpoint, the immature deny one aspect and try to establish another.” He goes on to say that “It is impossible to properly understand an entity consisting of infinite properties without the method of modal description consisting of all viewpoints, since it will otherwise lead to a situation of seizing mere sprouts on the maxim of the blind men and the elephant.”

Through the concepts of anekāntvāda (the notion that truth and reality are perceived differently from diverse points of view, and that no single point of view is the complete truth) and syādvāda (a system of logic that expresses uncertainty and ambiguity in relation to the complexity of reality. No single proposition can express the nature of reality fully) the parable can be applied directly to Bitcoin:

A group of blind men heard that a strange creation, called Bitcoin, had been brought into the world by a wizard called Satoshi Nakamoto, but none of them were aware of its shape and form. Out of curiosity, they said: “We must inspect and know it by touch, of which we are capable.” So, they sought it out, and when they found it they groped about it. In the case of the first person, whose hand landed on the cryptography, said, “This being is like complex mathematics.” For another one whose hand reached its distributed systems, it seemed like a kind of decentralized network. As for another person, whose hand was upon its economics, said, “I perceive Bitcoin to be like a system of production, consumption, and transfer of wealth.” And in the case of the one who placed his hand upon its politics said, “Indeed, this Bitcoin is like a debate among individuals hoping to achieve power.” Now, each of these presented a true aspect when he related what he had gained from experiencing Bitcoin. None of them had strayed from the true description of Bitcoin. Yet they fell short of fathoming the true appearance of the Bitcoin.

In an article entitled Why It’s Hard to “Get” Bitcoin: The Blockchain Spectrum, Dhruv Bansal, co-founder and CSO of Unchained Capital says, “Bitcoin is the convergence of cryptography, distributed systems, economics, and politics. It merges both technical and soft sciences and is more interesting and profound than you can imagine.” There is enough fruit for contemplation in the milieu of Bitcoin to serve as the launch pad for countless metaphysical adventures, without ever transacting or settling on the blockchain. Yet practical matters such as freedom and preserving our savings, among others, press at our minds, so it behooves anyone who has an inkling of the importance of this creation to fast track their education.

Another article worth looking at, on Forbes.com, from Dec 23, 2014, called The 5 Phases of Bitcoin Adoption, suggested that Bitcoin adoption would occur in five general phases. The fourth phase, called the Wall Street Phase is happening now, a little later than proposed in the article. The rising price, volume, and development of derivatives are unfolding, and the added specter of the coronavirus pandemic might be a further catalyst for mass adoption. This is really the crux of my thesis here: Wake up and teach yourself about Bitcoin as soon as possible, because it is about to enter its meteoric phase. Have you ever heard of a curve on a graph referred to as a hockey stick? This is it. If you come to understand the upshot of riding this curve, until Bitcoin reaches the Global Consumer Adoption phase, you may do well in preserving your savings, and then some. In the end, you have a choice in the richness of your experience (no pun intended). Will you walk right past the gates of paradise without even noticing?

[…] hang on to it for awhile, the chances that your satoshis will increase in value are great. Do your research, and if you decide Bitcoin is for you, start stacking […]